2022 annual gift tax exclusion amount

Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

Gift Tax Exclusion For Tuition Frank Financial Aid

The exclusion is per.

. You can give up to this amount in money or property to any individual per year without incurring a gift tax. The tax rate applicable to transfers above the exemption is currently 40. You can give 45000 to three people.

What is the gift tax annual exclusion amount for 2022. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

North Carolina Gift Tax All You Need To Know Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Much Money Can You Gift Tax Free The Motley Fool

Tax Related Estate Planning Lee Kiefer Park

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

Gift Tax Limits And Exceptions Advice From An Expert Money

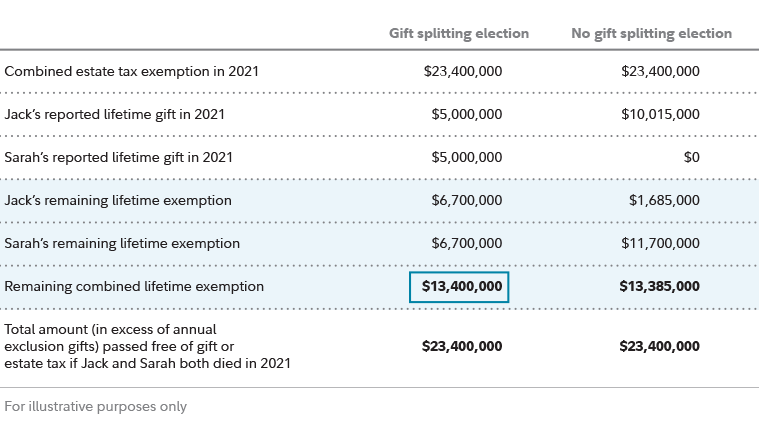

Estate Planning Strategies For Gift Splitting Fidelity

How To Give To Family And Friends And Avoid Gift Taxes Wtop News

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Irs Offers New Identity Protection For Taxpayers Identity Protection Irs Business Tax Deductions

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Historical Estate Tax Exemption Amounts And Tax Rates 2022

New Estate And Gift Tax Rules For 2022 And Beyond In 2022 Tax Rules Estate Planning Estates

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Inflation Updates For 2022 Federal Estate And Gift Tax

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022